Envision Your Retirement Transition Planning

This post is sponsored by VSP Individual Vision Plans. All thoughts and opinions are my own. Envision your retirement transition planning.

We all hope to have the quality of life that keeps us comfortable in the years ahead. Retirement may not be something that you think about when you are just starting out your independent life, but it does come up quickly and it’s great to prepare at any age. My husband’s parents spoke to us early on in our married life about this topic, and as they retired, we took their advice about what to plan for. Now with our own young adult children, we are helping them to plan for the golden years and their futures. Honestly, it’s never too early and we are guiding them to set money aside and invest wisely to grow their own nest eggs as we have done.

What do you envision yourself doing when you retire? We are a couple that loves to travel. We aren’t retired yet, and we hope to continue to explore the world when we do. My husband is really great at managing our finances with my input (of course!) and we started out as any young couple without much to our names. One of the smartest things we did early on was to put away as much as we could afford each month from our paychecks. Once we started our family, and expenses increased, we continued this practice and simply cut back in other areas. We had goals and visions and now it’s getting closer by the day to when we will retire. If you’re looking to start planning your own retirement, this financial planning and retirement guide from VSP Individual Vision Plans might be helpful in this journey.

While my husband does most of the financial planning with the help of our advisor, I make sure to keep our health goals on track. We work out (he is MUCH better about it that than I am!) and eat healthy meals. I cook dinner almost every night because I feel that you are what you eat and most restaurants just can’t compare to home-cooked meals. Since my work as a blogger is home-based, I carve out time during the day to prepare our meals. I have my groceries delivered and that saves me so much time! When you have a clear vision, your retirement transition planning should include a commitment to eating right.

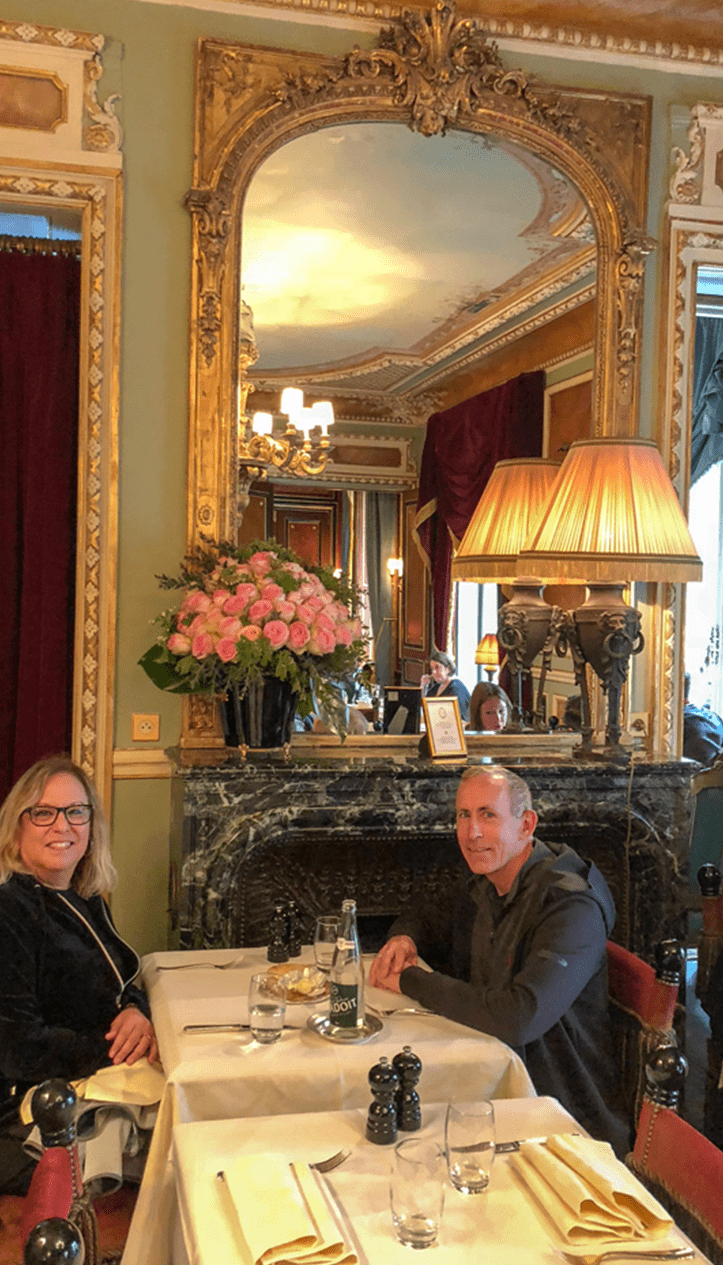

Recently we both went for our eye exams as part of our yearly health screenings. As you can see, I wear glasses (progressives) and thankfully we have VSP Individual Vision Plans to cover our vision care needs. It provides a sense of reassurance that coverage is available when necessary and helps us keep up on our yearly eye exams. I cannot see well without my glasses and ensuring good vision helps prevent falls and other accidents. VSP Individual Vision Plans are affordable, starting at just $13 a month, and give you access to the nation’s largest network of independent doctors and a generous allowance for glasses or contacts. You’ll save on glasses, contacts and specialty lenses (like progressives) which are not covered by your general health insurance plans or Traditional Medicare. Just about everyone I know wears either glasses or contacts!

We love to entertain and socialize and that’s important to us! Envision your retirement transition planning with friends and family in the picture more often. VSP Individual Vision Plans provide an average savings of more than $200 per year and members give the company a 95 percent overall satisfaction rating.

I recently wrote a post about Secrets To Smooth Travel As You Get Older and have some more tips there. Be adventurous and see the world and prepare beforehand as much as you can!

Here we are (above) in the Swiss Alps a few months ago, up at 12,000 feet! Thankfully it was a sunny and bright day, so we were able to stay warm and were ready if it was cold. Adventures like this are what we hope to continue well into our retirement years! A tip about traveling to high altitudes when you are from the flatlands like I am…did you know that there are ways to prevent altitude sickness with medication beforehand? I did not, but my regular doctor told me about it and next time I’ll be taking it for sure. Thankfully in my retirement I can keep going to my regular MD and continue to have my vision care covered separately by VSP Individual Vision Plans.

Saving for trips has allowed us to continue our wanderlust adventures now that the kids are on their own. We try and pace ourselves when we travel by taking time to just sit and enjoy a quiet meal.

So start to envision your retirement transition planning and check out VSP Individual Vision Plans for more information on this aspect of planning for your future!

For more information, go to GetVSPDirect.com or call 877-988-4746.

This is a sponsored post written by me on behalf of VSP Individual Vision Plans.

I LOVE this post Janet. We are quickly approaching this time in our lives and I’m thankful I have a hubs so good at financial planning as well. Thanks for broaching the topic. You’re never too young to start!!!

Thanks Kristi and it’s all a good life lesson for our kids!

We are quickly approaching retirement too! It’s exciting and terrifying all at the same time. I guess we all spend so many years working that travel is on the list. We would love to see much of the US and other parts of the world. 🙂

We began saving for retirement at the very beginning when we couldn’t afford anything! I thought my husband was crazy then but I’m so glad now. We are now teaching our sons who are in their 20s to do the same.

We did the same and honestly didn’t have anything either but a small rental apartment and both of us working hard. Finally it’s paid off and our kids have learned to do the same!

Well written post! My hubby too is great with our finances and our portfolio! It’s great to travel when you retire! I will check out the vision to see if it fits! Love all you do my friend!

Maria

Thanks Maria…we are so fortunate to have our plans in place! Enjoy your weekend…xo

What a great post!

Well I do thank you Patty and let me know if you have any questions.

When my husband & I were very young funds were setup for various things. Entertainment, education, RETIREMENT, etc. I learned very young you have to plan to achieve. My husband has long since passed. I still follow the same principles that we established when we were young. I can travel if I like or stay home and enjoy my surrounding right here in the good old U.S. Please let me add a parting message…..What ever you should decide to do, enjoy your togetherness.

What a thoughtful comment and we agree Margaret! Hopefully sometime in the next couple of years and in the meantime we try and enjoy every day…

It certainly helps to prepare in advance for your retirement which is looming very large in the near future. I feel that I could use a lot of help in this area since I am basically starting from scratch since the Greek financial crisis. Enjoy your travels and stay healthy!

Sorry that you’re going through that Mary and hope you can catch up!

GOOD INFO !! Thank You for sharing… we luv retirement !!

VSP is fantastic !! ~linda of no.cal.

Good to know that you love VSP Linda and retirement! Hope to join you in the latter some day, lol

I love your message Janet! Planning for retirement is so very important. Like you and your husband, we started out with just the love between us, but also like you we had parents who instilled in us the importance of planning ahead! Caring for ourselves both regarding our health and our finances has always been one of our life goals!

Isn’t it a good feeling when you start to reap the rewards of the saving and planning? Hope all goes well for you in the years to come!

Good advice, Janet. Our son and daughter-in-law were just talking about their little 401k’s and how there isn’t much in there (yet), but we encouraged them to try and put more into them so they would grow quicker. Retirement sneaks up on people I think, and in our case we are having to play catch up with Hubby’s job loss a few of years ago. We have had VSP in the past and do again with his current company. I cannot say enough good about VSP, people! Our current plan has a low copay compared with past employer’s eye insurance. I can say from personal experience that VSP is easy to work with over the phone and can explain anything you need answered.

Good tips for anyone nearing retirement, Janet!

Barb 🙂

What a wonderfully thoughtful comment and I’m glad that you have had a positive experience with VSP!